The Importance of Succession Planning

by

Planning for your retirement is something that is often joked about lightly as if it will never actually happen, and then next thing you know you are finishing up your last day and you have a lifetime of work that has built up for you to pass on. As a financial advisor, you truly have had a lifetime of hard work and relationships compile in order to have a successful career. At CollaborativeWEALTH®, we have worked with quite a few financial advisors, and have crossed the paths of many that didn’t take the time to plan their succession. If you’re on the fence about whether or not it’s worth taking the time to do, then there are a few things that you should know.

Accuracy

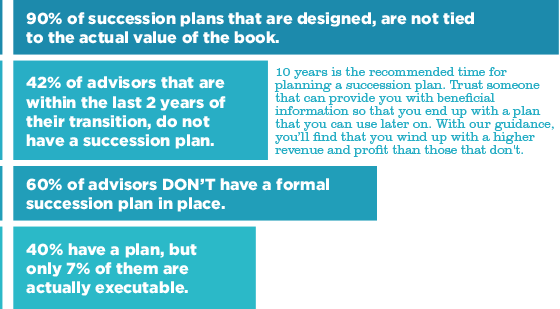

When you have worked long and hard to build a book of clientele, the last thing that you’re going to do is pass them off easily. These are people who you have become close with, that have entrusted you with their finances. Your hard work, determination, and attitude have also helped you build the physical size of your book, and at the end of the day when you pass that off you want to make sure that you are getting the value back. 90 percent of succession plans that have been created last minute is not tied to the actual value of the business, which means that people are missing out on the hard work that they’ve put into creating their reputation. When you have an experienced team of financial advisors that are creating your succession plan, you know that.

Loyalty

As we talked about in the prior point, the relationships that you create at this time are ones that you have a lot of loyalty to, especially if you have been their financial advisor for an extended amount of time. When getting ready to plan who is going to take over your book, you are going to want to make sure that you can trust them and count on them to provide the same quality and care to these individuals that you did. While this is something everyone wants to achieve, nearly 42 percent of advisors that are in the last two years before transitioning their books to a successor don’t have a plan ready. That means that close to half of the books that are getting ready to pass on, might not be going to someone that can provide the best care, which could come back and hurt your reputation. We help you find high-quality financial advisors to take over your book so that you can feel confident with the transition.

CollaborativeWEALTH® can ensure that the clients you’ve worked with for years are being passed along to someone that you can trust. Come in today and let us help you out with your succession plan. We will work through the kinks together so that you are confident in the plan that you are moving forward with. Call us today and schedule an appointment to work with a member of our team.